NOTABLE CASES

After reviewing the Motion, I was concerned about certain charges listed in the affidavit signed by a representative of the Creditor, and accordingly set an evidentiary hearing for June 24, 2008. Of specific worry was a charge for $2,114.10 in “penalty interest…” As to the “penalty interest,” both the Creditor and FDLB conceded at the hearing that this was an erroneous charge and that the Creditor was never entitled to payment on this sum.

Christine L. Herendeen, a lawyer at FDLG, testified as to the circumstances encompassing this case. Creditor’s new counsel examined Ms. Herendeen, and provided a disclaimer prior to her testimony that, “[s]he has independently done a brief review and has a rough idea of the numbers and she can testify to that, but she won’t be able to say with exactitude the cases that these were filed in . . .” Transcript of 9/18/2008 Hearing at pg. 44. I asked Ms. Herendeen who at FDLG had prepared the false affidavit; she could not tell me.

She did not, however, make any representation that she (or anyone else at FDLG) had, in fact, reviewed any of the state court files in any of the foreclosure cases in which FDLG had filed false affidavits on behalf of Wells Fargo in the bankruptcy courts to assure the accuracy of that assertion.

What is evident is that FDLG prepared the affidavit in this case and the Creditor’s employee signed it without any review. See Transcript of 6/24/2008 Hearing [DE 39] at pg. 29-34. The actual ramifications of this conduct are still unclear to me. What is even more troublesome is that this conduct was not unique to this case. Once counsel and Creditor realized their wayward accounting, it should have set off alarms, not just a “brief review.” Instead, a lackadaisical approach was taken in which the parties threw up their hands and said “no harm, no foul,” but without, in fact, determining either the full extent of the false affidavit problem in the bankruptcy court stay relief motions or that no false affidavits had been filed in the subsequent state court foreclosure proceedings.

Again, it is unclear to this court whether there is no harm to the debtors involved or to their estates. If the properties sold for more than the alleged debt, then there would indeed be harm. If the Creditor was able to write off the “loss” of spurious penalty interest on its books (and perhaps on its tax returns) then that would appear to constitute harm. And so on.

Since FDLG has provided no more than a cursory estimate as to the cases in which FDLG filed false affidavits claiming “penalty interest” and vaguely fleshed out an analysis as to this conduct, I am left baffled by FDLG’s lack of appreciation for the severity of the problem presented and by its casual response. It is well worth noting that this is not the first occasion in which I have witnessed sloppy and unprofessional conduct in FDLG’s practice of law.

In Chambers v. NASCO, Inc., 501 U.S. 32 (1991), the Supreme Court addressed the nature and scope of the inherent power vested in the federal courts. The judicial branch has the overall ability to control judicial proceedings, i.e., to maintain the decorum of the institution, which includes the conduct of parties involved. Chambers, at 501 U.S. at 43-44.

“Trustee Christine Herendeen (“Trustee”) filed an adversary action against Creditor for allegedly engaging in improper debt collection practices. After Creditor challenged the suit as frivolous, Trustee voluntarily dismissed the case.”

In its Motion for Leave to Sue, Creditor expressed its intent to sue Trustee and Counsel for violations of the Racketeer and Corrupt Organizations Act (“RICO”), malicious prosecution, civil conspiracy, and violations of the Florida racketeering statute (including mail fraud, wire fraud, extortion, and conspiracy) and attached the proposed complaint. In support of its claims, Creditor alleged that Trustee and Counsel had engaged in an improper scheme, which, if proven, could amount to improper solicitation. The complaint asserted that Counsel had a paralegal sit in on creditors’ meetings during the bankruptcy process to mine for debt collection causes of action to be pursued.

Trustee and Counsel opposed the Motion to Reopen. Trustee raised several defenses to Creditor’s proposed claims: 1. the claims are preempted by the Bankruptcy Code; 2. the claims are barred by the litigation privilege; 3. Trustee and Counsel are immune from suit; 4. the claims are collaterally estopped; and 5. Creditor failed to establish a prima facie case of any of its claims.

Concerns were first sparked on May 11, 2012, when USTP attorney J. Steven Wilkes filed an unusual discovery request before the U.S. Bankruptcy Court in Tampa, Fla. The Wilkes request raised serious issues about the USTP’s independence and whether CFPB is trying to politicize the judicial program so it can do the bureau’s the bidding on data mining, according to bankruptcy and constitutional law experts.

The Trustee bears the burden of establishing that the compromise is fair and equitable. While the Court does not have to conduct a “mini-trial” on the merits of the underlying litigation, “[a]pproval of a compromise under Bankruptcy Rule 9019 requires more than just a ‘rubber-stamping’ of an agreement.” This Court agrees with the general policy of encouraging settlements and favoring compromises to reduce the costs of litigation.

In evaluating the Trustee’s proposed compromise, “the court’s role is to ensure that the trustee has exercised proper business judgment in making the decision to agree to the proposed settlement.” Courts give trustees considerable deference to exercise their business judgment with respect to settlements. The Trustee’s business judgment, however, is not without limits. “There must be at least some rational business purpose to support the disinterested trustee’s decision.”

Eric Ortiz filed his Chapter 7 bankruptcy to get a fresh financial start. His case was uneventful and uncontested. At the meeting of creditors, Mahendru asked the Debtor about calls he received from debt collectors before filing bankruptcy. Based on the Debtor’s answers, Mahendru hired the Collection Attorneys to file two adversary proceedings—one against Capital One and one against Wells Fargo. The litigation against Capital One settled for $4,000 with approximately $1,050 available to pay creditor claims. Now, I am asked to approve a similar settlement with Wells Fargo for $3,900 with only $1,015 of this amount available to pay creditor claims; professional fees and costs account for 74% of the recovery.

So, if this second compromise between the Trustee and Wells Fargo were approved, who would get paid? Only three proof of claims were filed totaling $8,832.48.

[Trustee] Mahendru, here, never looked at the claims filed or the identity of Mr. Ortiz’ creditors or lack thereof. Why would anyone sue when the only independent creditor claim totals $125.18 and the settlement actually harms the creditors? I conclude that Mahendru has failed to exercise his reasonable business judgment. Both the creditors and the Debtor are better off if the settlement is denied.

Upon examination of the file in the above styled action, there is cause for recusal due to the undersigned’s familial relationship to Ashley Moody, Attorney General of the State of Florida, who is a named defendant in this action. James S. Moody, Jr. US District Judge

“The Undersigned is named as a Defendant in this action. Accordingly, pursuant to 28 U.S.C. § 455(a), the Undersigned recuses herself from all further participation in this case.” Mary S. Scriven US District Judge

“As a member of the United States District Court for the Middle District ofFlorida, the undersigned finds that she must recuse herself pursuant to 28 U.S.C. § 455(b)(5). Additionally, the undersigned finds it appropriate to recuse herself so as to avoid even the appearance of partiality or impropriety. See 28 U.S.C. § 455(a).” Charlene Edwards Honeywell US District Judge

“Further, having now reviewed these complaints, they are both due to be in their entirety. The named judges enjoy absolute judicial dismissed immunity for acts in their role as judges… It may be that at one time Kim had a real complaint against some party, but these lawsuits, as constituted, are frivolous.” Timothy J. Corrigan Chief US District Judge

For example, Plaintiff alleges that multiple judges across jurisdictions intentionally violated local rules and rules of procedure to prevent him from successfully litigating his numerous cases. (See, e.g., Doc. 5, at 32 (“McEwen does not believe in following Federal Rules, and apparently HONEYWELL, JUNG and BARBER also do not believe the rules apply to them. It appears CORRIGAN also believes his role is to protect other corrupt judges.” (emphasis in original)). He also asserts that the Bankruptcy Court for the Middle District of Florida “has a history of theft of debtor’s estates,” often engages in practices that deny parties due process of law, and conspires with judges of other courts to steal debtors’ property. Id. at 15.

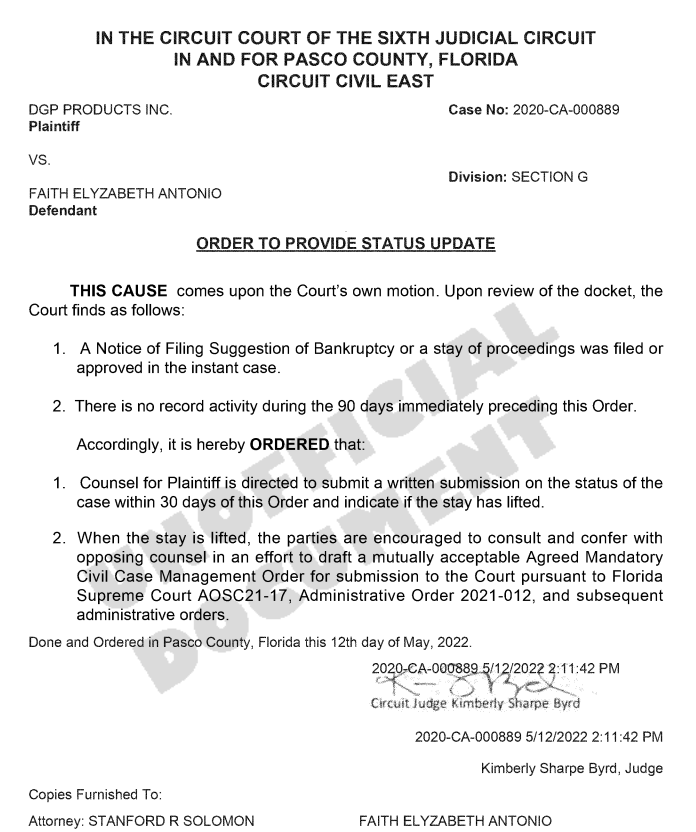

My Experience Has Been The Same As Above. Attorneys Colluding, I Have Been Defending Myself In A Proceeding Where Nothing Makes Sense. DGP nor my Ex was questioned or required to provide proof at any stage of this litigation. Harming my health as a disabled person. This case is still active and I want my freedom from this craziness.

"No stay has been issued or approved by the court."

- Bankruptcy court must approve all attorneys for debtor, not just its bankruptcy attorneys. Check with client’s bankruptcy counsel about getting approved if your client files bankruptcy.

- Discharge: Other exceptions (fraud, defalcation, false financial statement, willful injury) require an adversary proceeding to be filed before a court deadline (60 days after first meeting of creditors) to determine dischargeability. 11 U.S.C. § 523(c); Bankruptcy Rule 4007.

- A pre-petition claim against the debtor will ultimately be discharged if an exception is not applicable. A debtor’s discharge can be blocked entirely under Bankruptcy Code § 727 if the debtor commits bankruptcy fraud. A creditor’s claim is discharged even if the claim was not listed in the bankruptcy if the creditor had knowledge of the bankruptcy. Bankruptcy Code § 523(a)(3).

- Removal to bankruptcy court — Rarely works. Removal should be filed in district court under 28 U.S.C. § 1334 with a motion to “refer” the case to bankruptcy court if desired.

- Court has mandatory abstention for state court cases which are merely “related” to the bankruptcy rather than “arising under bankruptcy.” 28 U.S.C § 1334(c)(2).

- Relief from stay to liquidate claim or pursue insurance — Filed by motion in bankruptcy court. If there is no insurance, alternative is to file a proof of claim in the bankruptcy and wait to see if it draws an objection (however, there is no specific time limit for objections).

- Filing a proof of claim subjects the creditor to bankruptcy court jurisdiction if that is a concern (may lose right to litigate in state court).

- Reducing a debt to judgment doesn’t in itself create any higher priority in the bankruptcy (absent a recorded judgment lien).

- Preferential payments or transfers (within ninety days for regular creditors, one year for insiders) — Can be recouped by trustee or Chapter 11 debtor. Any payment on an unsecured debt or improvement in secured position can constitute a preference. There are exceptions for subsequent new value, contemporaneous exchange, or payments in the ordinary course of business.

- Chapter 7 — Liquidation (either individual or corporate). Debtor turns over all his or its assets to a Chapter 7 trustee, who liquidates them and pays the proceeds to creditors.

- Automatic stay — Stops any action against the debtor or asset of the bankruptcy estate to

collect prepetition debt. Automatic stay takes effect immediately upon filing and stays in

effect until the discharge. A motion for relief from stay is usually filed by a secured

creditor but must also be filed to allow a lawsuit against debtor to proceed. - Proof of claim — Must be filed before deadline in order to be paid from bankruptcy.

Claim is presumed valid unless objected to. No need to file in a “no-asset” Chapter 7.

Attach evidence of debt, collateral and perfection. Don’t sign for client! - Section 341 meeting of creditors — Opportunity (usually brief in a Chapter 7, longer in an

11) to examine debtor under oath. There is no court reporter unless you bring one, but

the examination is recorded. Debtor will usually not be prepared, so it can be very

useful. You can file a motion for a Rule 2004 examination (more later) if you need more

time. - Plaintiff with knowledge of defendant’s bankruptcy has an affirmative duty to notify the court and to stop actions.

- File as a notice of stay rather than a motion to stay: “Notice of Bankruptcy Stay as to

Defendant Danny Debtor. Plaintiff hereby notifies the Court that defendant Danny

Debtor has filed a Chapter 7 bankruptcy in the U. S. Bankruptcy Court for the Southern

District of Alabama, Case No. 14-1000, and thus the automatic stay of 11 U.S.C. § 362(a)

is in effect as to that defendant.”

Judicial Misconduct Complaint

“Complainant who ended the relationship in November 2019 after years of abuse, is a disabled

litigant, a term of disabled within the Social Security Administration’s definition, at all relevant times.

There is a failure to consider how allegations of an employment history occurred after the ending of a

relationship and the credibility of such allegations with no documented history of employment since

Complainant never worked for DGP, she admitted she helped her boyfriend from time to time with his

home-based business. To accommodate this glaring issue, Judge McEwen stated that she does not care

about the (non-existent) employment relationship and only wants to determine who is credible.”