Solomon Law did a document dump of files on Attorney Karen McHugh for an unrelated Injunction Court hearing in the Sixth Judicial Circuit Court in Pinellas County pertaining to DGP v Antonio. Including a document titled, “Status of Non-Party Subpoenas for Depositions Duces Tecum (As of February 17, 2021).

On the page with BATES number 622, lists the Intuit Subpoena dated 12/10/2020. Solomon Law notes, “On 1/7/2021, Intuit responded with a series of objections. We have resolved many of these objections and expect production within the next 10-14 days.”

Intuit never contacted me regarding any accounts seemingly attached to any former e-mail accounts that appear within the documents provided nor was there any objections filed by INTUIT on the record, see Adversary Docket.

This statement would have the reader believe that Intuit provided Solomon Law production in January 2021.

Solomon Law filed Summary of Discovery provided to Debtor, on page 6 it states:

04.22.21 – Non-Party Document Production of Intuit.

If Intuit produced documents in January 2021, Solomon Law waited months before providing this production.

Why would Solomon Law fight so hard to prevent Intuit from producing the same document production directly to the Defendant, if there was nothing to hide?

“Debtor is seeking duplicative, already produced records from BlueHost and Intuit [Doc# 446]. Debtor is seeking records concerning third party applications from BlueHost [Doc# 446-1]. Debtor is also seeking not only Intuit documents related to DGP but also irrelevant Intuit data pertaining to DG Auto [Doc# 446-1]. DGP has gone through a long and expensive process to secure documents from both BlueHost ad Intuit to produce to Debtor.“

“DGP requests that this Court put an end to Debtor’s endless duplicative requests and deny Debtor’s additional request for records from Intuit and BlueHost. Intuit and BlueHost should not have to re-produce the same documents.”

The question is, if any of the accounts were created and owned by Defendant, as they claimed, how would Intuit’s production harm DGP? Second, if the process was expensive for DGP to secure, how does it harm DGP for Intuit to produce the same documents to the Defendant?

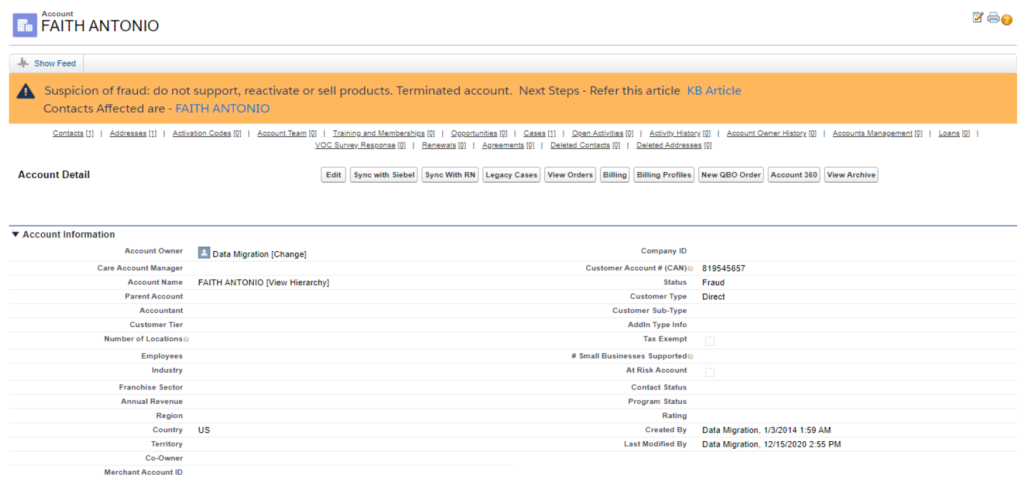

DGP claims it provided all documents, but there is no explanation why Intuit did not provide any documents for account 819545657 especially when the account owner is listed as data migration that occurred on December 15, 2020. Obviously there is data, so where are the documents?

I have also uploaded some of the documents through a website called Metadata2go that also shows discrepancies. For example, the document titled, “Merchant Account Changes_Redacted” (the document given does not show any redactions but for the purposes of confidentiality I redacted the phone numbers prior to uploading).

On page 3, I attached the results from the scan of metadata and the author is Lisa Riffe who is a Risk Analyst with Intuit. The document creation date is January 14, 2021. On page 4, there is a modification date of April 22, 2021 at 4:27am. This is after the date of the certification of business record. Intuit is located in California. Again, the Intuit files were produced to me April 22, 2021, in the afternoon.

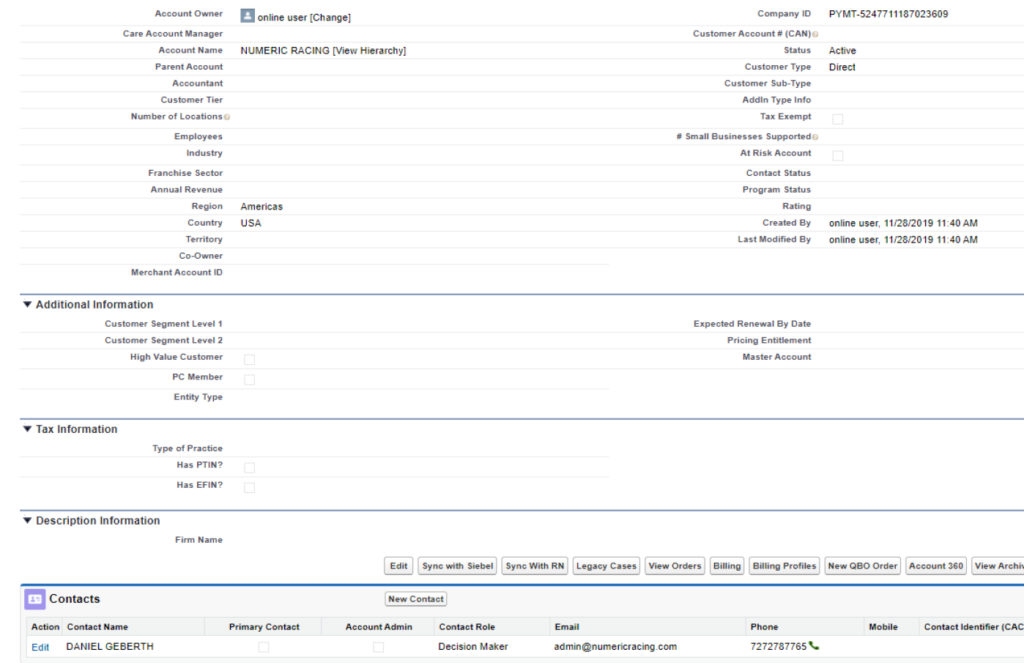

Another inconsistency is from Intuit account 3609, it says created by online user on 11/28/2019 but the documents provided contain data since 2017.

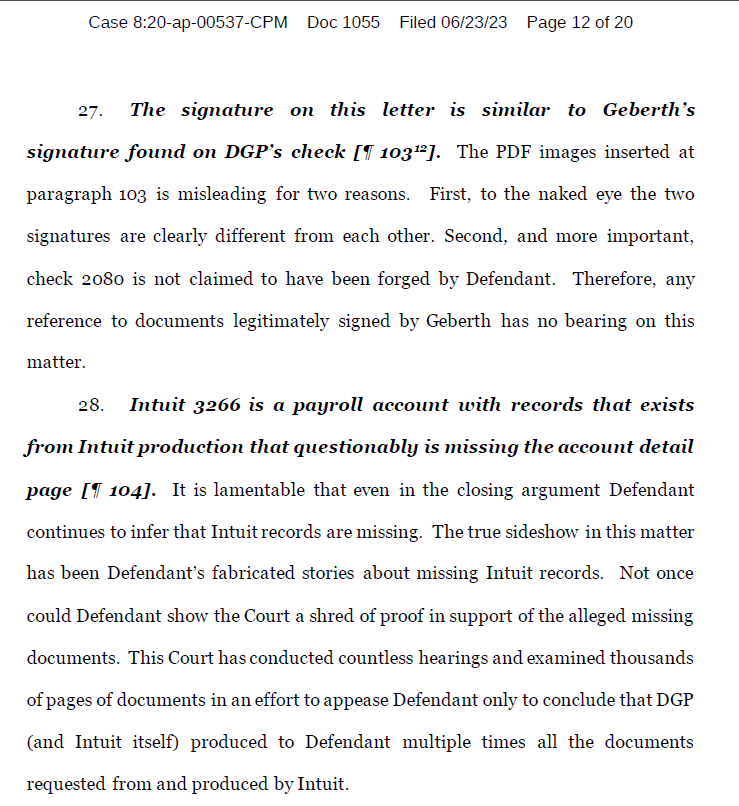

DGP'S Rebuttal Closing Argument

Every time I brought up the missing records, I was talked over and interrupted by Garcia-Cruz. DGP requested the Court an order to Intuit. DGP made incredulous claims that they could not provide an audit trail from their own software, reflected below, because Intuit cuts off access after two years. (Unimaginable). They never provided me the audit trail where I can see the history of each transaction, as promised. I was not requesting an audit trail from Intuit and they continued to confuse the court, again, by talking over me and interrupting me knowing that the stress causes me to become non-verbal.